The Gardner Report, 2014

Now is the time of year when many prognosticators – like myself – start to gaze into the future and attempt to see what the year has in store.

As I look in the rear-view mirror, 2013 can be considered another year of recovery with all major asset classes performing well, admittedly with no little amount of assistance from the debt and equity markets, as well as overall improved confidence in the U.S. economy.

So what am I seeing for this year? Here are my thoughts.

Employment

It was certainly pleasing to see that in the Fall of 2013 – after five long and grueling years – employment in the Seattle metro area managed to return all of the jobs that were lost during the recession. The area shed over 124,000 positions during the recession, but has managed to not only claw all these back, but the current employment level is now 6,200 jobs higher than the prior peak. (Data as of November 2013.)

Although this is certainly positive for the market, I do have a word of caution. Somewhat counter-intuitively, employment growth in the metro area turned negative in the Fall of 2013 and, while this may be just an anomaly, it has certainly put a damper on my exuberance!

That said, I still see 2014 as a year when we will add to our total employment base, but the pace of growth will likely taper. I am looking at total employment rising by 2.5%, adding around 35,500 new payroll jobs to the Seattle metro area.

With this growth, the unemployment rate should contract from the current level of 5.6% to 4.8%.

Ownership Housing

Single family resale housing prices bottomed out at the end of 2011 at $340,000. By the end of 2013, the average sale price had risen by 28% to $436,000 which is encouraging; however, this is still 19% below the peak seen in the summer of 2007.

I anticipate that 2014 will continue to bring price growth with resale single family home prices growing by 5 percent – essentially matching the rise seen in 2013 for the combined metro area. Modestly greater price gains will be seen in King County than in Snohomish County, but will still be in the single digits. This slower growth model will be a result of rising interest rates as well as more tapered expectations from sellers. We saw list prices drop through the second half of last year – a necessary move as the relationship between average list price and average sale price was getting strained. As such, average sale price growth slowed and this will continue to be the case in 2014.

Listing activity, although 18 percent higher in 2013 than in 2012, is still not where I want it to be and I am hoping that this year will provide more choice for home buyers. There remains nagging concerns over the so called “shadow inventory”, but I maintain the position that this will not negatively impact aggregated values.

On the new construction front, I believe that we will see home builders support the market with the introduction of additional inventory; however, concerns over rising land values and construction costs will have many remaining wary. Finished lot values almost doubled in 2013 which has caused a somewhat bifurcated market with the national builders holding a significant advantage over the smaller local builders as they have the wherewithal to take down these expensive lots.

Additionally land constraints will continue to influence price and this will continue to be an issue in the new home industry.

Looking at the condominium market, we will continue to see a reemergence, but it is unlikely that we will see any additions to the inventory above the two projects currently under construction. Financing in this world remains tight even though demand for new condos appears to have returned.

Mortgage Interest Rates

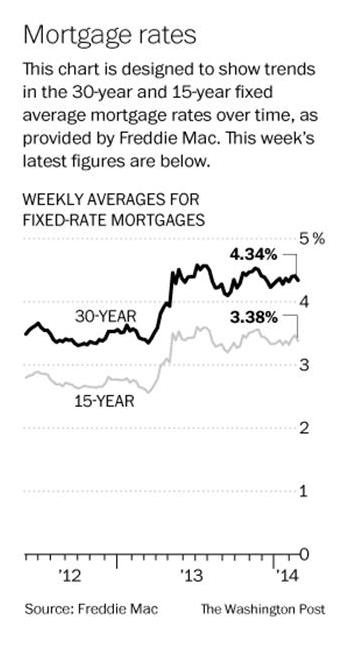

Mortgage rates are already on the rise and we are sure to see this continue through 2014 as the Federal Reserve continues to taper its purchase of mortgage-backed securities and treasury bills. The increase in rates will not, however, be abrupt, but rather gradual through the year but I would not be surprised to see the average 30-year fixed mortgage rate hit 5.4% by years’ end.

Before we all start to gesticulate madly that this is the end of the world, let us not forget that interest rates were substantially higher in the past (9% in 1990 and close to 20% in 1982!)

This does, however, add further credence to my belief that home price growth will taper this year as affordability — especially for first-time buyers — gets tested.

he time of year when many prognosticators – like myself – start to gaze into the future and attempt to see what the year has in store.

As I look in the rear-view mirror, 2013 can be considered another year of recovery with all major asset classes performing well, admittedly with no little amount of assistance from the debt and equity markets, as well as overall improved confidence in the U.S. economy.

So what am I seeing for this year? Here are my thoughts.

Employment

It was certainly pleasing to see that in the Fall of 2013 – after five long and grueling years – employment in the Seattle metro area managed to return all of the jobs that were lost during the recession. The area shed over 124,000 positions during the recession, but has managed to not only claw all these back, but the current employment level is now 6,200 jobs higher than the prior peak. (Data as of November 2013.)

Although this is certainly positive for the market, I do have a word of caution. Somewhat counter-intuitively, employment growth in the metro area turned negative in the Fall of 2013 and, while this may be just an anomaly, it has certainly put a damper on my exuberance!

That said, I still see 2014 as a year when we will add to our total employment base, but the pace of growth will likely taper. I am looking at total employment rising by 2.5%, adding around 35,500 new payroll jobs to the Seattle metro area.

With this growth, the unemployment rate should contract from the current level of 5.6% to 4.8%.