Housing around Western Washington is on an upward trajectory, but inadequate inventory “in the right prices and locations” makes for a “very difficult market for purchasers and brokers,” according to an executive with one multi-office real estate company.

New figures from Northwest Multiple Listing Service show inventory increased in May compared to a year ago, but brokers say competition is keen. “Multiple offers and escalation clauses occur on a regular basis for properties that are extremely well priced and in great condition,” reports Dick Beeson, principal managing broker at RE/MAX Professionals in Tacoma.

Mike Gain, a former chairman of the Northwest MLS board of directors, also commented on the bidding wars. “We are experiencing more multiple offers than I have experienced in my 35 years of practicing real estate in this marketplace,” stated Gain, the president and CEO of Berkshire Hathaway HomeServices Northwest Real Estate. “This is a very difficult market for purchasers, our agents and brokers. If we had inventory to handle the demand our pending and sold numbers would be greatly increased,” he believes, adding, “We desperately need good quality inventory.”

Last month’s pending sales topped the 10,000 mark for the first time in twelve months. The number of mutually accepted offers totaled 10,373, outgaining a year ago by 328 transactions for an increase of almost 3.3 percent. Last month’s total was the highest volume of pending sales since June 2006 when brokers tallied 10,448 transactions.

With demand outpacing supply in many parts of the region, brokers are noticing more creativity among competing parties. “Offer review deadlines have become pretty commonplace in this market, as have pre-inspections,” said OB Jacobi, president of Windermere Real Estate. He said some agents and buyers are getting even more aggressive by submitting their offer prior to the deadline.

Jacobi said there’s also an increase in the number of cash buyers, and buyers willing to waive their financing contingency, “making it even more difficult for the vast majority who don’t have this option.” With ongoing competition likely to continue, Jacobi expects agents and buyers to be “increasingly creative until the market becomes more balanced, which probably isn’t going to happen any time soon.”

MLS figures show months of inventory slipped to 3.33 from April’s figure of 3.46. In King County, supply stayed about even with April (1.78 months of inventory in May versus l.74 months in April). Snohomish slipped from 2.47 months to 2.37. Four to six months is considered to be a balanced market.

Fewer sales closed last month compared to a year ago (down 2.2 percent), but prices increased. Compared to April, the number of completed sales in May jumped by 997 transactions for a gain of 16.1 percent. Brokers reported 7,187 closed sales of single family homes and condominiums last month with a median selling price of $285,000. That sales price reflects a 3.6 percent increase from the year-ago figure of $275,000.

For single family homes (excluding condos) the area-wide price rose 4.2 percent, increasing from $285,000 to $297,000. Condo prices jumped nearly 15% from the year-ago price of $200,000 to last month’s price of $229,900.

Brokers added 12,605 new listings to inventory during May, about 10 percent more than a year ago. At month end, the selection across the 21 counties served by Northwest MLS included 23,917 active listings. That total reflects a 9 percent increase from twelve months ago when buyers could choose from 21,943 homes and condominiums.

In several counties served by Northwest MLS distressed properties make up about 20 percent of the activity, according to an analysis by Beeson. His figures show one of every five homes that sold in Pierce, Thurston, Kitsap and Cowlitz counties was distressed, while in King County such properties accounted for only around 10 percent of the sales.

Beeson, a board member at Northwest MLS, expects distressed properties will continue to be an integral part of the market. As median prices continue to rise around Puget Sound, he believes the inventory of short sales will be reduced.

“The inventory of bank owned properties holds steady at twice the number of short sales,” Beeson reported, adding, “This probably will not change in the foreseeable future as banks have warehoused much of their ‘shadow inventory’ and are slowly bringing it on the market so as not to glut the market, and to help keep pricing levels up, which benefits them as well.”

Another MLS director, George Moorhead, characterized the market as “sluggish” in areas. Buyers are about “45 days later to the starting line” compared to patterns of the past three years. “Some areas are still doing extremely well and still seeing multiple offers, but not on the whole,” observed Moorhead, the managing broker at Bentley Properties in Bothell. Overall, he believes “the market is righting itself slowly and becoming healthy and sustainable.”

Snohomish anomaly

Inventory in Snohomish County jumped 43 percent compared to a year ago. Asked about the surge, Moorhead attributed much of it to an influx of new construction. The MLS database shows 406 of 2,206 listings of single family homes are classified as new construction. That’s about twice the number from a year ago. “The price points are some of the best in the market areas for size, style and overall location,” Moorhead stated.

Rosy outlook

Despite inventory shortages, Northwest MLS brokers were mostly upbeat about short-term activity:

- “Locally, the summer selling season can be the busiest time of the year. This year with the lack of inventory it is probably the best market sellers will ever experience,” suggested Mike Gain.

- “We anticipate the market remaining at modest levels of growth [in Snohomish County] and inventory levels continuing in a healthy range of seven to eight months instead of two to three months.” — George Moorhead

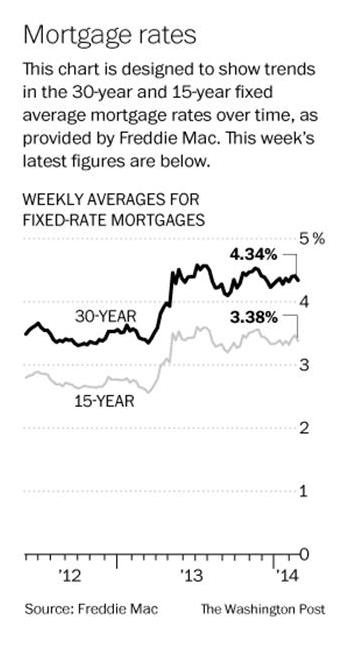

- “Home buyers received a summer gift, just in time for the home buying season: interest rates have come down one third of a point from a month ago.” – J. Lennox Scott, chairman and CEO, John L. Scott Real Estate.

- “In almost every county, inventory increases since last year have brought a sigh of relief from many buyers . . . If interest rates continue to hold under 5 percent and the unemployment picture continues to improve or remain the same, we should see a moderate to strong market throughout the balance of 2014.” – Dick Beeson. Wilson urged sellers to make sure their home is exposed “to as many real estate brokers from as many real estate firms as possible to ensure all buyers in your area and price point have a chance to make an offer on your home.”~NW Multiple Listing Service

- Buyers also need to be prepared, Wilson suggested. In addition to being fully approved for financing a mortgage before making an offer, buyers need to be mindful that their offer “may not be the only one being tendered to a seller” and be poised to respond.

- MLS spokespeople encouraged potential sellers to consider listing now. “Now is a great time for move up sellers/buyers who can sell their homes quickly today and secure another at today’s prices and today’s low interest rates,” Gain suggested. He also noted the majority of homeowners have experienced significant gains in their equity over the past two years. “Sellers who took their homes off the market in the down market can now get the prices they were wanting when they made their decisions to rent them. The prices are back and the homes will sell,” he emphasized.

~NW Multiple Listing Service